Can Amex Credit Limit be increased automatically | Does Amex automatically increase the credit limit.

If yes then how to increase the Amex credit limit? In this article, I will give you some insights into American Express cards as well as solve doubts regarding questions like does Amex increase credit card limit automatically. So, stick till the end to know all about amex and its working.

Their banks handle the majority of the everyday financial transactions, but they don’t manage every step of the procedure. Several businesses connect your banks to the purchases you make with your debit or credit cards. These businesses are typically payment networks like Visa card and Mastercard, which don’t actually offer you a card but rather only assist in managing the transaction between the banks and the merchants.

On the other hand, American Express issues its own cards, finances your purchases, and controls the money transfer. American Express will charge you for this service in the form of interest or one-time fees. Additionally, businesses pay them a charge to process their payments.

The American Express payment method is a safe and quick credit card payment method that is accepted in more than 130 countries and has over 100 million active cards. Amex cardholders spend up to four times as much as Visa and Mastercard cardholders, per the data. That is what distinguishes American Express as one of the most popular payment options available. These are the main advantages of accepting Amex on your website or online store:

A wide variety of supported currencies; Amex’s round-the-clock service and support; SafeKey 3D Secure security.

Trending: How do I activate 10play on my TV?

American Express (Amex) can automatically increase your credit limit, but this is not guaranteed. The choice to increase your credit limit is influenced by a number of criteria, including your credit score, payment history, income, and spending patterns.

If you use your card responsibly and make on time payments, Amex may check your account on a regular basis and consider increasing your credit limit. This is not a promise, and Amex can even reduce your credit limit if they notice any changes in your credit history or payment habits.

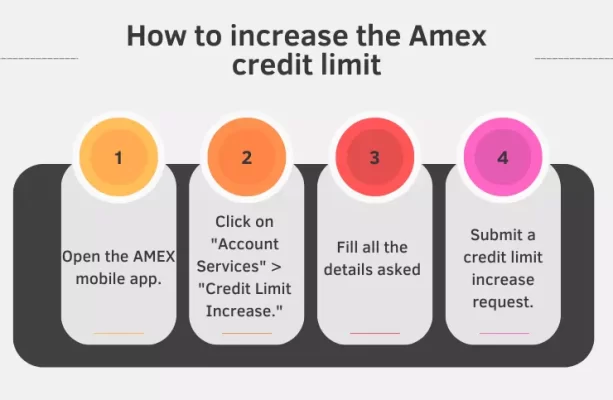

How to increase the Amex credit limit? You can increase your American Express credit limit by doing the following:

How to increase the Amex credit limit via phone call

However, before you request for a credit limit increase you must remember that American Express will check the credit before increasing your credit limit. So make sure you have a decent credit score and a solid payment history before making the request. Furthermore, seeking a credit limit increase may result in a hard inquiry on your credit report, which may temporarily reduce your credit score.

Brownie Read: Activate Your Schools First Federal Credit Union Card

For consumers with good or exceptional credit scores who want to earn points on US purchases that they’ll pay for in full by the due date every month, an American Express card is a terrific investment. If you desire a low-interest introductory period in addition to perks, an Amex card can be worth it.

The American Express card is worthwhile to have as long as the money saved by using it surpasses or cancels out any yearly fees. Of course, what other credit card issuers are providing also affects whether a specific Amex card is the best overall choice. Amex competes more fiercely in some markets than others.

Amex cards, for instance, are plainly not ideal for establishing credit, and most of them aren’t suitable for financing new purchases or debt transfers. Nevertheless, many American Express cards offer excellent perks for food-related costs, and the Membership Rewards program makes nearly all Amex cards suitable for travel.

You know now if Amex increases credit limit automatically or not and how you can actually increase it by request. However, what if your request actually gets declined, what you can do in that case?

Trending: Can Amex Credit Limit be increased automatically: How?

Here is what you can to if you get denied for a credit limit increase.

When you ask to increase your credit limit, you will get instant answer, if it will be approved or not.

If case, you are denied, then you need to wait for six months before you trying again. During that time you can work on making payments on time and increasing your income. Doing these things can help improve your credit score and increase your chance of receiving a credit limit increase later on.

Conclusion

To summarize, American Express Amex can automatically increase your credit limit if you fulfill specific conditions, such as maintaining a strong credit score, making on-time payments, and showing responsible card use. However, there is no certainty that the credit limit will be increased automatically even if you meet all the criteria. Changes in a cardholder’s credit history or payment behavior have an impact to increase or lower the credit limit. Hope this guide is useful to you and solves all your queries regarding AMEX credit limit increase. If you still have queries you can feel free to ask us in the comments section below.

For every three months, you can request for a credit limit increase. However, you may request a credit limit reduction at any time.

No, Amex don’t do a hard pull for credit limit increase. A decent credit score is enough in most cases to increase the credit limit.

Amex decides your credit limit based on your cibil score, Income details, payment history. If you have a high income and good credit score you will have more credit limit.

Yes, Amex can increase your credit score if you make all the payments within the due time and maintains and maintains low credit utilization score.

Leave a Reply